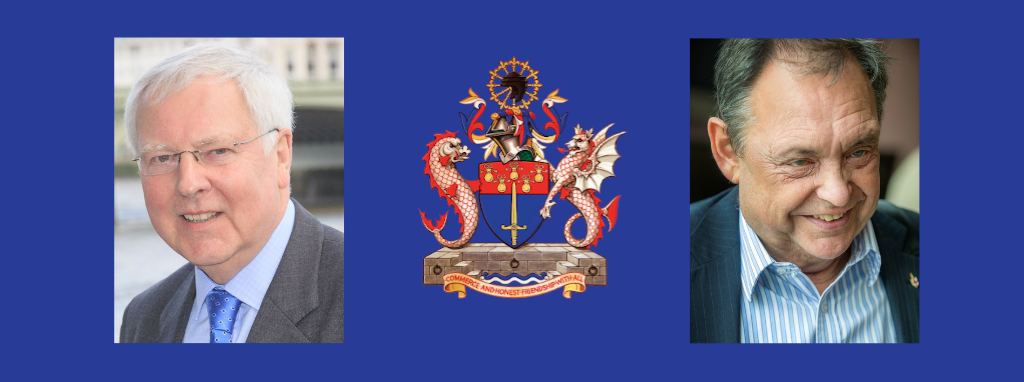

The World Traders’ 6th Phoenix Talk was, in fact, two talks. Up first was a double act from Mark Olbrich and Professor Sam Whimster detailing the consequential effects of changes in the retail sector. This was followed by John Burbidge-King discussing the threats to business from organised crime and corruption.

The demise of the retail sector and its consequences

Mark Olbrich’s career started in retail, including managing several companies, but for the last 25 years he has been working within the private equity world on the operations side. Mark explained how the pandemic has accelerated changes in shopping habits as consumers make more purchases online, particularly in non-food retail. Luxury brands have been resilient in the short term but the evidence is that even these sales are moving online. This has led to bankruptcies, not just in the high street but also in retail parks. The effects have been exacerbated by some questionable business decisions by some retail groups, who sold off the freehold of the shops they owned for short-term gains only to be hit by rising rents in a falling market. In turn, these bankruptcies have hit the retail property sector. In the US many malls have closed and US retail property bankruptcies total $4.5bn.

Furthermore, reduced demand for office space has prevented retail developments being recycled as offices. As a result, there will be an impact on property financiers and the financial sector in general. There are plans for three more major skyscrapers to be built in the City of London by 2036 but with valuations on the floor their future is uncertain.

Mark believes that in the long term these trends will affect the structure of Britain’s economy. Increasing online functions underpin an explosion in the number of tech companies, which will be followed by other new technologies such as robotics. The pandemic has shown the importance of controlling supply chains leading to the onshoring of production. For example, more clothing is now being manufactured in the UK than was the case recently. Taken together, all this marks a shift from a service economy to an industrial economy. In short, a new industrial revolution.

Sam Whimster is a Professor at the Global Policy Institute London and teaches urban and cultural sociology at London Guildhall University. presented a sociological model of changes in the retail sector. He contrasted the situation in Bridport in Dorset, where he was speaking from, with Oxford Street in London, where he usually lives. Bridport has a 400 yard long High Street and only three closed shops whereas Oxford Street has seen the closure of many shops including large department stores. Sam suggested that Bridport High Street was healthy because the shop owners had maintained control of their own distinctiveness as well as owning their own freehold. This meant they were able to offer all types of people products they wanted but could not find easily online. He cited the example of two artisan bakeries. On the other hand, for shops on Oxford Street the brands they sold were more important than the shops themselves. This meant both that the items could be sourced easily online and that he shops had little distinction one from another.

Corporate Crime and the “Get Out of Prison Card”

John Burbidge-King was Master of the World Traders in 2013. After a career in the Royal Marines and De La Rue, in 2006 he founded Interchange Solutions which works with organisations worldwide to mitigate bribery risk. John’s talk made use of data from a recent report from the National Crime Agency. John started by pointing out that there only needs to be “one bad apple” in an organisation to cause extensive problems. He outlined what he referred to as “potential criminal touchpoints” within a company such as IP theft, cybercrime, money laundering, fraud, bribery etc. Very often individuals will profess a rationale that justifies their behaviour to themselves. Smaller companies are particularly at risk as they are likely to have less sophisticated checks in place.

The NCA report that Serious Organised Crime has been largely resilient to the pandemic although some types of crime have increased relative to others. Crimes that involve transport, such as human trafficking, immigration crime and firearms, have unsurprisingly decreased but it is in the nature of SOC that as one door closes activity increases elsewhere. Thus 2020 saw an increase in online crimes such as child pornography, fraud and ransomware. Metal thefts, including catalytic converters from cars, have also increased. These trends may well reverse when the pandemic restrictions come to an end.

SOC operates like any other business in requiring lines of communication and supply chains. This means that they need secure messaging. This was exploited recently in a sting operation spearheaded by the FBI and the Australian security service. They enabled the distribution of phones to criminal organisations which contained a messaging app called Anom. Anom purported to be a secure messaging app but actually allowed the security services to listen in real time to criminal conversations leading to hundreds of arrests. A smaller successful sting was run by the French and Belgian police.

As one example of this success, John described the disruption of shipping cocaine from Guyana to Belgium involving the arrest of corrupt police officers, border staff and lawyers. The pandemic has increased fear in people of losing their job, which creates fertile ground for bribery.

John turned next to the question of where does all the illicit cash go? He outlined the many different routes of money laundering and pointed out that it requires professional facilitators in financial services. Others such as art dealers may also be involved. John also covered the leakage of public money from the system through tax evasion, abuse of foreign aid and embezzlement by public officials.

The “Get Out of Prison Card” referred to in the title of John’s talk was actually a “Don’t Go to Prison in The First Place Card”. John argues that pre-Covid compliance regimes are not fit for purpose when it comes to home-working. So, the ”Get Out of Prison Card” is knowing and considering the new risks. The best way to avoid the “one bad apple” is to engender trust in the company by creating a working team that feels like a family. This occurs when people feel good about the organisation they work for.

The meeting concluded with half an hour’s fellowship in breakout rooms.